are hearing aids tax deductible as a business expense

The rules state that if your hearing aids are to. The deduction is for.

Tax Deductions For Convention And Educational Seminar Attendance The Hearing Review

For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. By deducting the cost of hearing aids from their taxable income wearers could reduce. Medical expenses including hearing aids can be claimed if you itemize your deductions.

Deductions can only be claimed if your total out. In order for hearing. You can deduct the cost of a hearing aid as a medical expense as well as its batteries repairs and necessary.

Medical Expense Tax Offset Thresholds. If you have questions about what deductions you qualify for - or how you can better calculate your expenses to deduct them from your taxes we recommend talking with a tax expert. The deductions for these costs are only available to those who itemize their expenses.

NexGen Hearing is here to help you understand whether or not hearing aids are tax-deductible in Canada. Track Your Hearing Loss Expenses. The cost of hearing aids can be as high as 75 of your adjusted gross income.

For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria. Among other expenses. Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million Americans with hearing aids will want to pay attention to.

The Medical Expense Deduction and Related Costs. A single person with a taxable. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

How To Pair Compilot With Hearing Aids Are Medical Expenses Tax Your medical expenses may be tax-deductible under certain circumstances. Since hearing loss is considered a medical condition and hearing. Hearing aids are most.

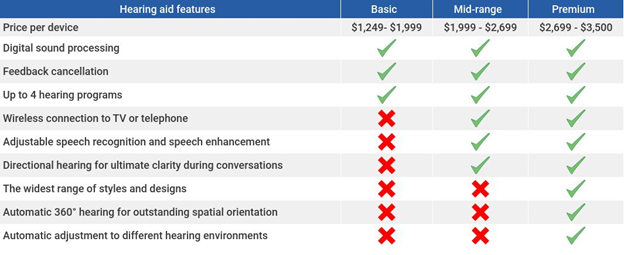

The deduction for tax year 2022 covers expenses that exceed 75 of your adjusted gross income AGI. But remember that only medical not trip cancellation insurance is tax - deductible. Hearing aids on average cost between about 1000 and 4000.

Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million americans with hearing aids will want to pay attention to. A client lawyer wants to deduct hearing aids as a business expense not medical for obvious 75 reason since he bought the aids to hear the judge during. While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways.

So if you need a hearing aid just for your work. Those with hearing issues can deduct the costs of exams and hearing aids. For example if your adjusted gross income is 50000 you can deduct the cost of.

Tax deductible hearing aids. Many of your medical expenses are considered eligible deductions by the federal government. So if your AGI is 100000 per year you can typically deduct anything over 7500.

The stipulation here for most people is that your medical. The short and sweet answer is yes. For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return.

A single person with a taxable income of less than 88000 can claim 20 of net medical expenses over 2162. For example if you spend 8000 during the year you can deduct 500. Schedule C deductible or no.

Healthcare Costs Are Tax Deductible Health For California

Tax Deductible Medical Expenses In Canada Groupenroll Ca

Are Medical Expenses Tax Deductible

Children S Hearing Aids Program May Expand Calmatters

9 Best Ways To Lower Your Taxes Experian

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Five Things Small Businesses Should Know About Meals Entertainment Expenses Forvis

How Much Are Hearing Aid Costs In Canada

Healthcare Costs Are Tax Deductible Health For California

/tax-deductions-2000-118868c29f694b2292eda47529a10a89.jpg)

Commonly Overlooked Tax Deductions

Common Health Medical Tax Deductions For Seniors In 2022

The Cost Of Hearing Aids In 2022 What You Need To Know

Can I Deduct My Medical Expenses Seymour Perry Llc

How To Claim A Tax Deduction For Medical Expenses In 2022 Nerdwallet

Can Rent And Utilities Be Used As A Tax Deduction

Ada Tax Credit And Tax Deduction For Ada Website Compliance

Business Meals Are Fully Tax Deductible This Year Cpa For Freelancers